Carbon Neutrality in China and Europe: trend 2020-2060

Special focus on the role of hydropower in the global energy transition

by Frosio Next

March 2026

China and the Decarbonization Challenge

Carbon neutrality by 2030? Highly unlikely for China, despite ongoing efforts. As of 2024, the People’s Republic of China remains the world’s largest emitter, with a heavy reliance on coal, which still accounted for 66% of national electricity production. This dominance persists even as renewable sources—solar, wind, nuclear, and hydropower—have grown significantly, now exceeding conventional thermal capacity in terms of installed power.

However, only about 22–29% of actual electricity consumption was met by these sources. Still, a first decline in emissions was observed in 2025, with an estimated 1% year-on-year reduction—signaling that the transition, albeit gradual, has begun.

2030 Goals: A Turning Point, Not the Final Destination.

China’s official climate plan aims to peak emissions “before 2030” and achieve carbon neutrality by 2060. The targets include a 65% reduction in carbon intensity compared to 2005 levels, increasing the share of non-fossil energy to 25% of the mix, and reaching a combined solar and wind capacity of at least 1,200 GW. However, according to Climate Action Tracker, these goals are still rated as “highly insufficient,” mainly due to the lack of an absolute emissions cap.

Structural Challenges in the Transition

China faces enormous technical and economic challenges. Coal dependency remains strong: in 2024 alone, 66.7 GW of new coal power capacity was approved. Massive investments—estimated at over $17 trillion—are needed to further scale up solar, wind, hydropower, smart grids, and storage systems.

The heavy industrial sector (steel, cement, chemicals) is particularly difficult to decarbonize, making technologies like carbon capture and storage (CCS) and green hydrogen essential. Additionally, growing energy demand forces the government to maintain reliable fossil fuel reserves.

Hydropower’s Role in China’s Energy Strategy

In this scenario, hydropower plays a key role. Often overlooked in renewable energy discussions, it is one of China’s most stable, flexible, and strategic sources.

Over the past two decades, China has heavily invested in large-scale dams and reservoirs—including the Three Gorges Dam, and newer projects like the Yarlung Zangbo mega-dam (expected to generate 300 TWh annually). Hydropower also provides critical grid services: base and peak load power, flood control, water security, and black-out prevention in underdeveloped regions. However, its environmental and social impact requires more sustainable long-term planning.

Looking Ahead: 2055 and Beyond

Europe and Italy: More Advanced, But Not Yet Carbon-Free

Meanwhile, the European Union shows promising results. In 2024, 47–50% of electricity was produced from renewables—especially solar, wind, hydropower, and biomass—plus an additional 24% from nuclear. Fossil sources accounted for less than 22%, with coal dropping 68% from its 2003 peak.

Hydropower also plays a key role here, especially in Alpine and Nordic countries, where it consistently contributes to annual electricity production. In Italy, for instance, hydropower accounted for around 20% of total electricity production in 2024—significantly higher than in other Mediterranean countries.

Hydropower in Europe: A Stable and Strategic Resource

While China has made hydropower a centerpiece of its national strategy, Europe continues to rely on it as a structural element of its energy transition.

In countries like Italy, France, Switzerland, Austria, Sweden, Norway, and Finland, hydropower represents 20–30% or more of national electricity mixes, providing continuity, flexibility, and modulation. Unlike solar and wind, which are intermittent, hydropower enables fast response and frequency regulation, crucial for integrating variable renewables. It also helps balance energy markets, especially in interconnected and mountainous areas.

However, expansion potential is limited due to environmental constraints and near-saturation of suitable sites. Therefore, the focus is shifting to:

- Revamping and optimizing existing plants

- Integrating digital technologies and high-efficiency turbines

- Connecting with storage systems and smart grids for demand flexibility

- Developing pumped storage to ensure reserve capacity and rapid response.

Hydropower won’t be Europe’s fastest-growing energy source, but it will remain a technical backbone, ensuring resilience in a high-renewable scenario.

Italy: Progress Amid Constraints

In 2024, renewables accounted for over 41% of Italy’s electricity production (peaking above 45%), with a 13% year-on-year increase, including a 30% surge in hydropower. Yet, the energy mix is still gas-dominated (around 37%), making a carbon-free Italy by 2030 unrealistic. The National Energy and Climate Plan (NECP) sets a target of 39.4% renewable share in total energy consumption by 2030. But sectors like transport, heating, and industry remain heavily fossil-fuel-dependent.

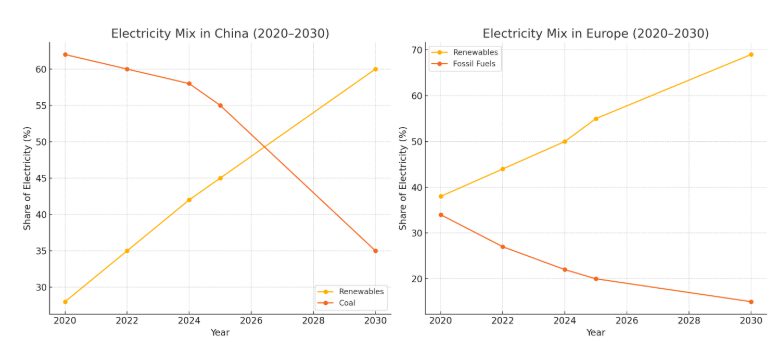

Electricity Mix Trends (2020–2030)

- China: Fossil fuel share is expected to drop from 66% to 35%, with renewables and nuclear rising to 60% of the mix.

- Europe: Shows a faster shift toward an almost completely carbon-free electricity sector by 2030.

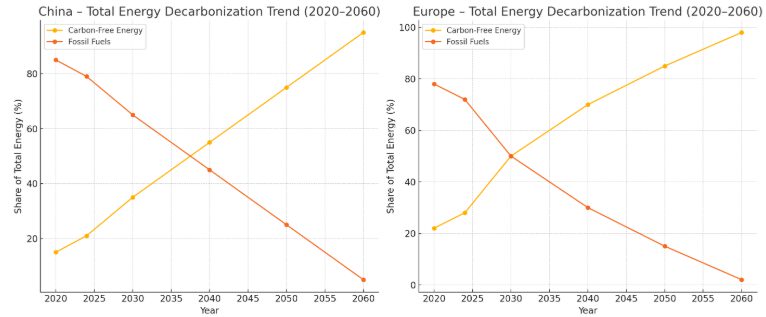

Long-Term Decarbonization Projections (All Sectors)

- China (2020–2060): Fossil sources expected to fall from 66% to 5%.

- Europe (2020–2060): On track for an even faster transition to a near fully carbon-free energy system by 2060.

Conclusion: A Two-Speed Future

In the power sector, Europe may reach a near carbon-free mix by mid-century, thanks to accelerated integration of renewables and nuclear.

However, this path demands sustained investment, strategic vision, and regulatory stability, which are currently challenged by economic pressures and fragmented governance at both EU and national levels.

China, despite its heavy coal dependence (66% in 2024), follows a more centralized and long-term planning model, with rational investment and fewer political or regulatory disruptions.

Find out more news

CALCAGNA hydropower plant: the first kw has been delivered to electrical power grid

February 11th, 2021: the new Calcagna hydroelectric plant on the Mella river has become operational. FROSIO NEXT followed all the design phases (from the revision of the original project to the construction design), and construction phases (Works Supervision, Safety and Commissioning).

Hyposo Project: final balance and results

Hyposo Project: final balance and results

Hydraulic works: What they are and why design is important

Discover one of the main activities carried out by the Frosio Next team deepening the method and implementation used

Contact us

Do you want to start a great project with us?

Fill the form and get in touch with us.